In early June 2021, many families received a letter from the IRS that they are eligible to receive advanced payments of the Child Tax Credit (CTC) as part of the American Rescue Plan Act of 2021 (ARP Act) signed in March. By July 15, as many as 39 million families will begin to receive direct monthly cash payments through the expansion of the CTC. These monthly payments are temporary and the results of some small but critical adjustments to the CTC that had previously mostly benefited middle- and high-income families through reducing their tax burden. The payments will be available for individuals earning up to $75,000 Adjusted Gross Income (AGI), heads of households earning $112,500, and couples earning up to $150,000 AGI much like other COVID-19 stimulus payments. This new CTC expansion increases the total amount of the CTC for most families, makes the CTC fully refundable, and pays half the value in estimated advanced monthly payments. To help understand the changes to this tax credit and why it is predicted to substantially reduce child poverty, we will explore how similar expansions of other tax credits—specifically the Earned Income Tax Credit—predict the CTC expansion’s effects.

Expanded Child Tax Credit for 2021

- Monthly payments. July to December: $300 per child under six; $250 per child age six to 17.

- Tax refund. Remaining half of year as a fully refundable tax credit.

- Income threshold (adjusted gross income)

Individuals: $75,000

Heads of households: $112,500

Couples: $150,000

The American Rescue Plan Act of 2021

The ARP Act substantially increased aid to states, local governments, and individuals who had been hit hard by the COVID-19 pandemic. The act included provisions for direct aid, including stimulus payments to individuals as well as funding for COVID-19 treatment, testing, and vaccination. The act also substantially expanded government aid to families by expanding two different tax credits: the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). The EITC is generally available to low-income families and is fully refundable so families that do not owe taxes receive cash payments from the EITC. The CTC, in comparison, is only partially refundable so it primarily affects middle- and upper-income families that owe taxes by reducing their tax burden.

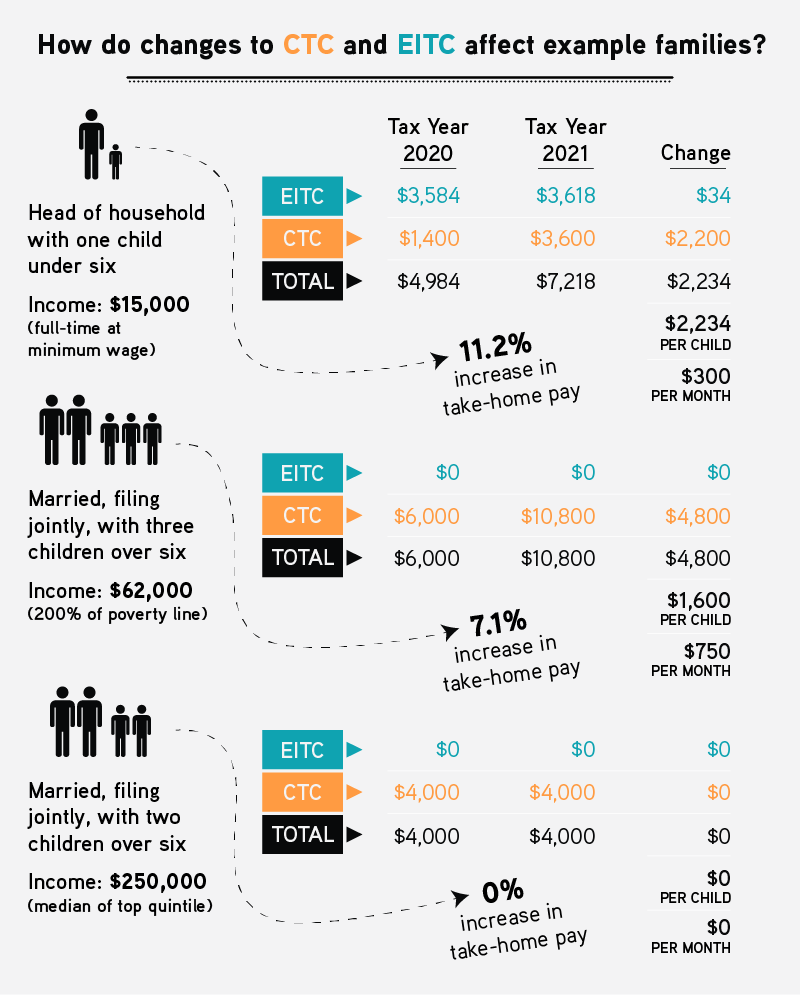

The expansion of the CTC in the ARP Act makes it behave more like the EITC. For 2021, it will be fully refundable so low-income families (in addition to middle- and higher-income families) will receive cash payments. Further, the ARP Act includes a provision for monthly payments rather than a once per year payment or decrease in tax liability at tax time. Beginning in July, families will receive monthly payments up to $250 for each child age six to 17 and $300 for each child under six. This increase represents a total expansion from $2,000 per child to $3,000 per child six and older and $3,600 for children under six. The new credit not only expands the amount of money available to families, it provides half in monthly advanced payments rather than a one-time lump sum.

This expansion of the CTC is one of the most substantial changes to income support for families with children since the expansion of the EITC in 1993 and the Personal Responsibility and Work Opportunity Act of 1996, which is commonly referred to as welfare reform. Currently, the changes will only apply for 2021 but a permanent expansion is part of President Biden’s proposed American Families Plan.

This expansion of the CTC is one of the most substantial changes to income support for families with children since the expansion of the EITC in 1993…

These three adjustments to the CTC—monthly advanced payments, higher payments, and fully refundable status—make the CTC function much more like the EITC for low-income families and is projected to reduce child poverty by 40 percent. To understand the potential effects of both this one year program and potential permanent expansion we explore its closest policy cousin—the EITC—including what the EITC is, how it is paid, who is eligible, and the research on the long- and short-term effects on families. Overall, the EITC has had substantial positive effects on families including on health, income, and education.

The Basics of the Earned Income Tax

The Earned Income Tax Credit (EITC) is a means-tested[1] social program intended to provide income support to lower-income families with children. The credit is designed to incentivize employment because it is worth less at very low-income levels and phases in as families earn more and then phases back out as families approach the maximum-income eligibility threshold. The EITC was greatly expanded in 1993 both in terms of the per-child credit amount and the maximum number of qualifying children allowed. There have been a number of other expansions and eligibility changes to the credit over the years.

The EITC is distributed as a fully refundable tax credit. In order to receive an EITC payment, families must file taxes with the appropriate EITC form, meet the income requirement, and have a qualifying child. The maximum qualifying income is based on marital status and the number of children. In 2019, a single person with no children was eligible for up to $529 if that person reported an Adjusted Gross Income (AGI) below $15,570. In contrast, a married couple with three children was eligible for up to $6,557 if their AGI was below $55,952. At very low levels of income, the credit “phases in,” meaning a family earns a higher credit as they earn more income. At income levels approaching the maximum, the credit “phases out,” so a family receives less in the credit as they earn more income. The average payment that a family receives is around $1,000 per child and the estimated “effect” of the EITC is generally measured as the impact per additional $1,000 in credit payments.

The EITC is the largest federal entitlement program outside Medicare, Medicaid, and Social Security. According to the IRS, in 2020, the program paid $62 billion to 25 million families which amounts to a $2,461 average payment. Not everyone who is eligible for the EITC receives it. Because the EITC is a tax credit, recipients must file with the IRS to receive the credit even if their income is so low that they are not otherwise required to file. The program has a relatively high take-up rate of 78 percent and low administration cost of less than 1 percent of payments.

Earned Income Tax Credit 2021

| Maximum Qualifying AGI | |||

| Single | Married | Maximum Benefit | |

| No Children | $15,980 | $21,290 | $543 |

| One Child | $42,158 | $48,108 | $3,618 |

| Two Children | $47,915 | $53,865 | $5,980 |

| Three Children | $51,464 | $57,414 | $6,728 |

In addition to the federal EITC, 29 states have their own programs as well. New York enacted its own EITC (NY-EITC) program in 1994 after a federal expansion of the EITC in 1993. This program essentially doubled EITC payments to low-income families and has been credited with reducing poverty and lowering reliance on other forms of public assistance for these families. In 2006, New York further expanded the NY-EITC to noncustodial parents in order to encourage those parents to work and pay child support, which resulted in a modest increase in parents who paid their full child support obligation.

The EITC has been an important policy lever for supporting families in times of economic hardship. In response to the Great Recession, the EITC was expanded as part of the American Recovery and Reinvestment Act of 2009 and that expansion was continued in 2012. This ran parallel to expansions of in-kind supports for families, including expanded eligibility for the Supplemental Nutrition Assistance Program (SNAP), sometimes referred to as food stamps, and the National School Lunch Program, which determines if students in public schools are eligible for free or reduced price school lunch.

EITC Spending: Paying Down Debt and Buying Durable Goods

The EITC is currently the largest and most substantial source of direct payments to lower-income families, as such it has also been the subject of substantial research across disciplines. Differences in EITC eligibility and take-up over time, geography, and phase-out income thresholds have allowed researchers to compare very similar families that did and did not receive the EITC to estimate the causal impact of the credit.

One of the unintentional benefits of the EITC’s lump-sum payment structure is that it functions as a “forced savings” mechanism. Rather than reducing the paycheck level tax withholding or offering a monthly-income support for families, families receive their full eligible credit as part of their tax refund. Nearly 90 percent of EITC expenditures are paid to families through tax refunds with the remaining 10 percent used to reduce the tax burden of families that owe the IRS. Due to this structure, EITC payments are distributed once a year rather than monthly like other in-kind family supports, including SNAP, WIC, or access to free or subsidized childcare, Head Start, and public school.

The EITC has been an important policy lever for supporting families in times of economic hardship.

A 2008 study found that less than 1 percent of households took advantage of a program that would spread out EITC payments throughout the year and that nearly all payments occur in February and March. Households that receive the EITC in a lump sum more than double their income the month they receive their refund check. The study found that 63 percent of households used some or all of the payment to pay down debt. The EITC was also used to purchase big-ticket durable goods like appliances, electronics (such as computers), and cars. The purchase of a car was a particularly common and important use of the EITC with recipients six times more likely to buy a car in February. Transportation provides an important employment support for many families. In much of the country, employment and education opportunities are severely limited without access to a vehicle.

An earlier study divided EITC expenditures into two categories: “ends meet” expenditures such as paying off debts and current bills and “social mobility” investment expenditures that would improve earning potential in the future such as moving expenses, mortgages, cars and other transportation, education expenses, and repairs. They found that more than half of EITC spending among the low-income taxpayers surveyed in Chicago went towards these social mobility expenses.

Short- and Long-Term Effects of the EITC on Children and Parents

The goal of the EITC is to improve the circumstances of lower-income families through subsidizing employment income. This additional income—both from the credit itself and from additional employment earnings incentivized by the program—has the potential to improve the health, education, and general well-being of children. The two most extensive reviews of the scholarly literature on the EITC since the 1993 expansion have found positive effects of the EITC in nearly all aspects of qualifying families’ lives including a substantial reduction in child poverty across a variety of poverty measures, maternal and child health, children’s education, and employment primarily for single mothers. Extensive research into the EITC finds that is exactly what it has done.

Prenatal Impacts

The measured benefits of the EITC occur even before birth. An additional $1,000 of EITC payments to mothers with less than a high school diploma reduces the incidence of low birthweight by 6.7 to 10.8 percent with the largest effects among Black women. The effect appears primarily driven by increased access to prenatal care and a reduction in negative health behaviors like smoking, which has been shown to reduce birth weight and lower APGAR scores (a measure of overall newborn health).

Educational Attainment

There is also evidence that the EITC has long-term effects on children whose families receive the benefit. A study that focused on teenagers found that an additional $1,000 in EITC exposure (the average amount of payment per child) when a child is between 13 and 18 modestly increased the probability of that child completing high school, completing college, and being employed as a young adult. The earnings from that employment also increased.

A study focusing on the 1993 expansion found similar results for high school graduation and college-going and also found an increase in math scores for children in families eligible for the EITC. These results were higher for children of color and boys. Another study found improvements for reading test scores.

Child Well-Being

A study of the 1993 expansion found that additional EITC payments improved children’s home lives and safety by both reducing the incidence of accidents in the home and improving home environment observation scores, both of which are likely to improve children’s socioemotional skills. This home environment score includes wide ranging questions about home life including cleanliness, disciplinary practices, safety, television usage, reading time, and the safety of the home. EITC also modestly improves food insecurity.

Parental Impacts

There is evidence that the EITC has a positive impact on the lives of parents as well. In studying the 1993 expansion in the EITC, Evans and Garthwaite (2014) find that self-reported maternal physical and mental health improved for mothers who received higher payments under the expansion. Although self-reported health can be a murky measure, they found that biomarkers related to poor health and stress also declined in women likely exposed to the expanded payments.

The expansion of the EITC (as opposed to other social support programs) was intended to encourage lower-income parents to work as payments increase as incomes increase. After a series of expansions including the 1993 expansion, employment rose substantially for single mothers. This increase was stronger for women with more than two children (those subject to the 1993 expansion) and those in states with supplemental EITC programs like New York.

What the EITC Teaches Us About the 2021 CTC Expansion

Prior to the 2021 expansion, the CTC primarily supported middle- and upper-income families by reducing their tax burden. Lower-income families, who generally do not owe income tax, could not take full advantage of the credit because it was only partially refundable. The EITC, in comparison, was fully refundable and targeted only low-income families. The 2021 CTC expansion makes it function more like the EITC for lower-income families in that they receive the fully refundable credit. Additionally, the payments will be made monthly rather than once per year.

A clear disadvantage to the EITC traditionally is that it is paid only once per year and may leave families without funds to deal with expenses that occur at a point in the year before the EITC is distributed. If families held traditional savings, they would be able to access those funds in times of emergency. A pilot-program study in Chicago found that advanced periodic payments of the EITC (payments similar to the monthly nature of the 2021 CTC) resulted in lower levels of reported stress, lower debt loads, and fewer unpaid bills. This sheds light on how the monthly CTC payments are likely to be used for different types of expenditures than the EITC. A further study of the same pilot found similar results. These monthly payments may also help smooth consumption for families dependent on income supports.

There is substantial evidence that “coming up short” at the end of the month has substantial negative effects on families. Studies of SNAP (food stamp) benefit recipients find they are more likely to visit food pantries at the end of the benefit cycle and more likely to report hunger. Delinquent unproductive debt—the type taken on to meet basic needs like utility payments or rent—also has the potential to perpetuate poverty even if that debt is eventually paid down. Short-term “pay day” loans, which charge interest in excess of 1000 percent, substantially contribute to bankruptcy and can trap borrowers in a cycle of debt. Most low-income households receive no rental assistance, so the payments may also help families avoid eviction. Having an eviction on your record reduces the probability of finding new housing, increases the rent on that housing, and decreases the quality of the housing and neighborhood it is in.

Nearly 90 percent of all children in the US will receive a monthly payment under the expanded CTC.

A further advantage of the 2021 CTC may be improved take-up. The three COVID-19 stimulus payments used existing tax records to issue checks which eliminated the usual necessity for people to know of and apply for tax credits based on their personal financial circumstances. In order to receive the 2021 refundable CTC families would only have had to apply for the standard CTC, not the EITC through their 2020 tax returns or applied for any of the previous COVID-19 stimulus payments. Nearly one in five of families eligible for the EITC do not claim it, so any process that eases the application friction for these credits is likely to improve take-up. Most families that are required to file taxes and are eligible for the EITC do take it up and that number is higher for families who use a tax preparer or tax preparation software.

The CTC expansion will also be available to higher-income families than the EITC. The maximum eligible income for the EITC is $57,414 for a married couple with three children. The expanded CTC is available for single parents making up to $75,000 and couples making up to $150,000. This much higher cutoff means that nearly 90 percent of all children in the US will receive a monthly payment under the expanded CTC. For middle- and higher-income people these advanced monthly payments are really a reduction of their 2021 tax burden but the salience of cash-on-hand may cause them to spend the money directly on child-related expenses like childcare and enrichment programs.

Moving Forward

Overall, the expansion of the Child Tax Credit in terms of higher value, full refundability, and monthly advanced payments has the potential to dramatically reduce child poverty and smooth the consumption of lower-income families over the year and month. The payments can provide income supports for monthly bills that do not have direct federal programs or have payments below what families generally spend. Because they are cash payments, families can spend them where they are needed the most, including on rent, utility bills, childcare, food, and clothing, without going into debt and using the yearly tax refund payment to pay down that debt. Lessons from the EITC show that the 2021 CTC expansion has the potential to improve both child and parent health as well as educational outcomes for children.

While the 2021 CTC expansion is not permanent, researchers and policymakers have long called for an expansion of the EITC that looks very similar to this temporary program. The studies discussed above show that states with higher EITC payments also have larger positive effects. The political discussion over potential EITC and CTC expansions is likely to continue over the next few months as the proposed American Families Plan would make the expansion permanent.

ABOUT THE AUTHOR

Leigh Wedenoja is a senior policy analyst at the Rockefeller Institute of Government

[1] A means tested program is one in which recipients must prove that they meet income and wealth eligibility standards as compared to a non-means tested program like universal public K-12 education, which is available to everyone regardless of income.