Trump’s Administrative Response to the Failed Repeal and Replace Vote Could Have Serious Consequences on Healthcare and the Federal Deficit

Last month, the Senate voted down three separate plans to repeal and replace all or parts of the Patient Protection and Affordable Care Act (ACA or Obamacare), culminating in a late-night rejection of the “skinny repeal” plan when Senator John McCain voted no. Despite the best efforts of the Trump administration and Congress, the ACA will continue to be the law of the land. Although Secretary of Health and Human Services Tom Price has said the administration will continue to implement the ACA, Trump has threatened to cut off critical payments to insurers, which could raise costs for the government and destabilize insurance markets.

As I wrote earlier this year, one decision that the president must make relates to Cost Sharing Reduction (CSR) subsidies, which reduce deductibles and other out-of-pocket costs for approximately seven million lower-income enrollees. Insurance companies waive these costs for qualifying enrollees and are later reimbursed by the federal government. These payments, however, have been controversial since they were initially made by the Obama administration without an explicit congressional appropriation. In May 2016, a federal judge ruled against the Obama administration’s payment of the subsidies, but the judge allowed for the continued payment of the CSR subsidies until all appeals were exhausted.

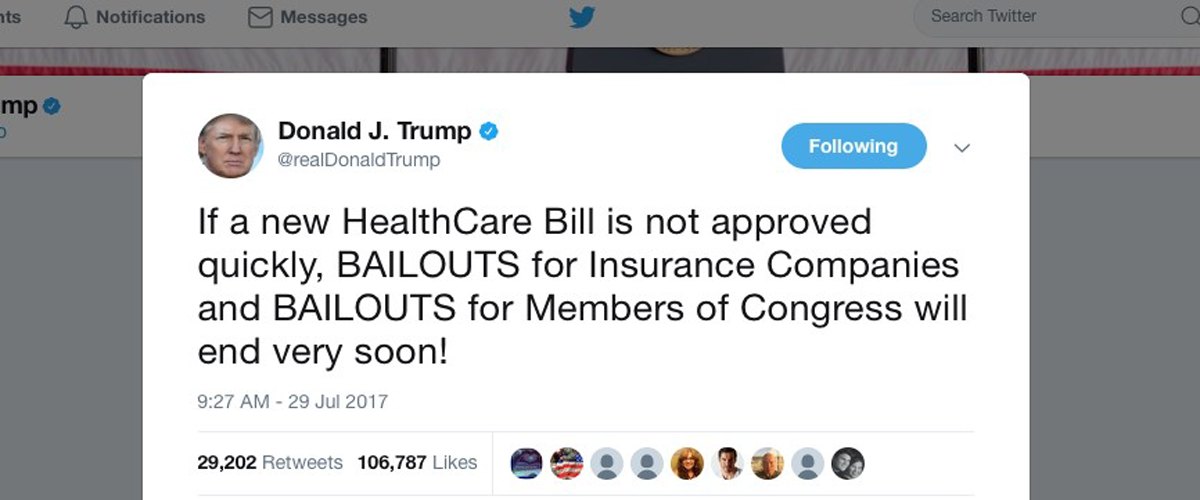

Up until this point, the Trump administration has continued to make the payments and, together with congressional Republicans, delayed the lawsuit as they sought to repeal and replace the ACA. Now that repeal efforts have failed, the Trump administration must decide if it will continue these payments. Thus far, the administration has sent conflicting messages. On one hand, Price has said that the administration will not let Obamacare implode. On the other hand, the president referenced these payments in a July 29th tweet, saying “If a new HealthCare Bill is not approved quickly, BAILOUTS for Insurance Companies and BAILOUTS for Members of Congress will end very soon!”

Halting the payment of these CSR subsidies would be a particularly obvious sign that the administration intends to sabotage Obamacare by causing major disruptions and rate increases in the individual insurance market.

First, it is now the time of year when insurance companies are determining their 2018 rates, so a change in course at this point would be particularly disruptive. In addition, many experts are also doubtful that stopping these payments would result in savings to the federal government. As unlikely as it seems, stopping these payments would likely end up costing the federal government more money than continuing to make them. The Congressional Budget Office confirmed this yesterday in a report and estimated that ending the CSR subsidy payments would increase the federal deficit by $194 billion over a 10 year period and increase premiums 20 percent for health insurance plans affected by CSRs in 2018.

Indeed, insurers have signaled that they would raise rates to recoup financial losses if these payments are withheld. If this were to occur, the ACA’s Advance Premium Tax Credits (APTCs), which are an upfront reduction in premium for lower-income enrollees paid by the federal government, would cover the premium increase for qualifying enrollees. Individual marketplace enrollees who do not qualify for APTCs would have to pay higher premiums. A report from the Kaiser Family Foundation, which explains the APTC formula, estimates that failing to make the CSR subsidy payments in 2018 would save approximately $10 billion but create new annual APTC costs of $12.3 billion, resulting in a net spending increase of $2.3 billion. Other experts have also highlighted that stopping these payments would likely lead to litigation from the insurers in the United States Court of Federal Claims, which could lead to the eventual payment of the CSR subsidies as well.

Second, halting these payments would also cause turmoil in the individual insurance market. A study by the consulting firm Oliver Wyman found that 42 percent of responding health insurance plans would likely withdraw from the individual market if payments were stopped. Another report from this firm found that up to two-thirds of 2018 rate increases are tied to uncertainty over this issue and enforcement of the ACA’s individual mandate penalties. The Kaiser Family Foundation estimated rates would need to increase by an additional 19 percent to account for these lost revenues.

A recent court ruling has limited the Trump administration’s options in this area. Last week, the United States Court of Appeals granted a request filed by New York and more than a dozen other states to defend the legality of CSR subsidy payments. Prior to this action, the Trump administration could have chosen not to appeal the 2016 ruling, which deemed these payments unconstitutional, and used this as a rationale for halting these payments. After this latest ruling, New York and the other Democratic states would have to agree before dropping the appeal, which is unlikely to occur.

To stabilize the ACA’s individual marketplaces and make the law function more smoothly, the president could commit to these payments in the short term, and Congress could appropriate the funds to settle the issue. After the collapse of the Republicans’ different proposals to modify the ACA, bipartisan groups at the federal and state level have suggested such an approach.

For now, however, the decision rests squarely with the Trump administration. The president must give a clear signal if he will continue these payments after the failure of reform efforts, or if he will sabotage the law’s implementation by withholding these critical payments. A decision is due by the end of the month.