Higher education is often touted as a gateway to living a better life. Having a college degree opens the door to many careers that offer a higher salary and increased job security, as well as providing better benefits. Although college is not the only path to success, earning a postsecondary degree does put a person in a better financial position over time — a 2015 study by the Georgetown University Center on Education and the Workforce found that the difference between the lifetime wages of college and high school graduates is one million dollars. Moreover, completing college also increases access to employment — by 2020, 65 percent of all jobs in the economy are expected to require postsecondary education and training beyond high school.

Despite the economic necessity of obtaining a college degree, the cost of higher education continues to rise. After adjusting for inflation, a report by the nonprofit College Board found that between 2011-12 and 2016-17 published tuition and fee prices rose 9 percent in the public four-year sector; by 11 percent at public two-year colleges; and by 13 percent at private nonprofit four-year institutions. Many states have adopted laws and programs to address college affordability, like free tuition programs in Tennessee and New York. Even though financial aid programs and scholarships can help soften the blow of college costs, many students depend on student loans to help finance their college education across the nation. This results in many students leaving higher education not only with a degree, but also with a mountain of student loan debt.

To make matters worse, proposed federal budget cuts could deepen the student loan crisis. In May, President Trump proposed sunsetting the Perkins Loan program, ending the subsidized Stafford Loans program, and eliminating the Public Service Loan Forgiveness program.

Student loan debt is second only to mortgage debt in the United States, accounting for 10 percent of the total debt balance; and totaling over $1.4 trillion. According to a live tracker on MarketWatch, student loan debt is increasing at a rate of $2,726 per second. Between 2004 to 2014, there was a nearly 90 percent increase in the number of student loan borrowers, half of whom are under the age of twenty-five. Nearly fourty-four million Americans are burdened by some amount of student loan debt; the average Class of 2016 graduate owes approximately $37,000 with an average monthly loan payment of approximately $350.

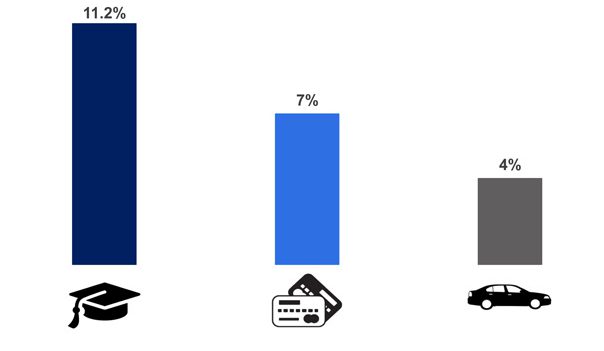

People are struggling to keep up with their student loan payments, with 11.2 percent of all student loan debt ninety or more days delinquent or in default in the fourth quarter of 2016, surpassing credit card loans (7 percent) and auto loans (4 percent). A survey by Bankrate.com found that 56 percent of people eighteen to twenty-nine years old have put off life events like getting married, purchasing a car or home, or saving for retirement because of student debt, which impacts not only the financial lives of the debtors, but the economy as a whole.

Percentage of Debt More than 90 Days Late or in Default

Source: Federal Reserve Bank of New York

The student loan industry also suffers from a poor track record of customer service for borrowers, who rely on companies to manage all aspects of loan repayment. From September 1, 2016, to August 31, 2017, the Consumer Financial Protection Bureau handled approximately 12,900 federal student loan servicing complaints, 7,700 private student loan complaints, and approximately 2,300 debt collection complaints related to private or federal student loan debt. This issue has been further exacerbated by the decision of US Secretary of Education Betsy DeVos to roll back federal provisions that protected borrowers by holding companies accountable for bad service and failing to help borrowers find more affordable ways to repay their loans. For example, the federal Department of Education now blocks protections against high fees to those borrowers who defaulted on their student loans.

In the last few years, more and more states have passed legislation to try and address the student loan debt crisis. In 2015, Connecticut became the first state to pass a borrower’s bill of rights that established a student loan ombudsman in the Connecticut Department of Banking and an educational financial literacy course for college students. The law also required that student loan servicers be licensed by the state banking department and prohibited them from defrauding or misleading borrowers. The Connecticut law has served as a model for legislation that has been introduced in states like Illinois, Maine, Massachusetts, Minnesota, Missouri, New Mexico, and Washington.

Other states have gotten involved with assisting residents in paying back their student loans. In 2016, New York announced the “Get on Your Feet” student loan forgiveness program, which pays up to two years of federal student loan bills for qualified applicants. Meanwhile, legislation in New Jersey directs the Higher Education Student Assistance Authority to forgive certain student loans in the event of student borrower’s death or total and permanent disability and grant deferment for temporary total disability. Maryland established matching state contributions to eligible college savings accounts and created a refundable tax credit. California’s proposed ReLIEF Act would help borrowers refinance their private student loans. The Rhode Island Student Loan Authority has the power to issue bonds and buy and invest in its own bonds and notes for the purposes of student debt consolidation.

Other states have focused on making sure that borrowers are educated about their decisions. Indiana requires higher education institutions to annually provide students with estimated amounts for incurred student loans, potential total payoff amount after interest, and monthly repayments; Nebraska’s public colleges and universities are required to provide students with detailed annual reports on their projected student loan debt; Washington legislation requires that students receive information on the total amount of educational loans and the range of payoff amounts including principal and interest. Michigan initiated a student loan delinquency counseling pilot program to help residents currently delinquent on their federal student loans.

While it is too early to determine what impact, if any, these various state regulations have on the issue of student loan debt, the Rockefeller Institute is planning to study the implementation of these programs to assess best practices. The student loan debt problem shows no sign of slowing down and more states are likely to pass legislation as debts continue to mount.

A Snapshot of Recent State Laws and Proposed Legislation Addressing the Student Loan Crisis:

- California (2017) — Senate Bill 674, known as the ReLIEF (Loan Improvement for Enhanced Futures) Act, puts aside $25 million in a fund that will be made accessible to private student loan agencies. In effect, this money would help secure a small percentage of the loans for students who want to refinance their student loans. The authors of the bill believe that this will encourage lenders to offer a lower interest rate to students.

- California (2016) — The Student Loan Servicing Act was enacted September 29, 2016. Student loan servicers located in California servicing loans made to residents of any state and those located elsewhere servicing loans made to California residents will be subject to a new licensing requirement. The law also imposes other significant new requirements and prohibitions on student loan servicers. The requirements and prohibitions are effective on July 1, 2018.

- Connecticut (2015) — Connecticut became the first state to pass a borrower’s bill of rights. The bill established a student loan ombudsman in the Connecticut Department of Banking, as well as an educational financial literacy course for college students. It also requires student loan servicers to be licensed by the state banking department and prohibits them from defrauding or misleading borrowers.

- Illinois (2017) — A Student Loan Bill of Rights has passed both houses of the Illinois legislature and is awaiting the governor’s signature. The bill would protect student loan borrowers by prohibiting student loan servicers from misleading borrowers and requiring that they properly process payments; require specialists to provide and explain to struggling borrowers all of their repayment options, starting with income-driven plans; and inform borrowers that they may be eligible to have their loans forgiven due to a disability or a problem with the school they attended. The bill would also create a student loan ombudsman in the attorney general’s office and require student loan servicers to obtain a license to operate in Illinois.

- Indiana (2015) — House Bill 1042 requires higher education institutions to annually provide students with estimated amounts for incurred student loans, potential total payoff amount after interest, and monthly repayments. Signed by Governor Mike Pence on April 14, 2015.

- Maryland (2016) — The College Affordability Act of 2016 was enacted April 2016 and established a matching state contribution to eligible college savings accounts and created a refundable tax credit of up to $5,000 for undergraduate student loan debt.

- Maryland (2016) — On April 26, 2016, the Maryland governor approved HB1015, which requires the Maryland Higher Education Commission and the Maryland Health and Higher Educational Facilities Authority, in consultation with the Department of Legislative Services and any other appropriate agencies, to study the expansion or creation of an appropriate bonding authority for the refinancing of student loans in Maryland. By September 30, 2017, they must report their findings and recommendations to the governor and the General Assembly.

- Maryland (2016) — House Bill 1079 authorized Montgomery County to create the County Student Loan Refinancing Authority. The bill requires the county to take certain actions, such as performing a feasibility study (completed June 27, 2017), before establishing the authority. Once the authority is established, it will be able to refinance student loans for eligible borrowers.

- Massachusetts (2017) — A bill was filed in the Massachusetts State Legislature that would create a Student Loan Bill of Rights. Student loan servicers would be required to register with the state and pay a licensing fee. Student loan servicers that are subject to oversight would be prohibited from engaging in unfair, deceptive, or abusive practices common in the student loan industry, such as misapplying payments or supplying misinformation. Student loan borrowers would be provided with the right to file a lawsuit against student loan servicers who violate the bill of rights. The state would also establish an ombudsman position to monitor student loan servicing and help student loan borrowers obtain out-of-court resolutions to their servicing issues.

- Michigan (2016) — A student loan delinquency counseling pilot program was initiated (January 1, 2017 – January 1, 2018) to help Michigan borrowers currently delinquent on their federal student loans. The program provides free one-on-one counseling for borrowers to develop a repayment plan that will return the borrower to good-standing and help with continued successful repayment. In addition, borrowers are provided with financial education to assist in the creation of a budget and to better understand their credit score.

- Nebraska (2016) — In April 2016, Governor Pete Ricketts signed a bill that requires Nebraska’s public colleges and universities to provide students with detailed annual reports on their projected student loan debt. Colleges will be required to inform students of the total amount of federal education loans they have received, the potential payoff amounts they can expect to pay, estimates of their monthly payments, the number of years they can expect to be in debt and how close they are to the aggregate borrowing limit. The measure goes into effect for the 2017-18 academic year.

- New Jersey (2016) — In December 2016, Governor Chris Christie signed into law a bill that directs the Higher Education Student Assistance Authority to forgive certain student loans in the event of a student borrower’s death or total and permanent disability and grant deferment for temporary total disability.

- New York (2016) — In December 2016, Governor Cuomo announced the “Get on Your Feet” student loan forgiveness program. For those qualified applicants, the program pays up to two years of federal student loan bills for state residents who graduated from a New York college or university after 2014, earn less than $50,000, and are enrolled in an income-based repayment plan.

- Oklahoma (2013) — The Oklahoma Private Student Loan Transparency and Improvement Act established restrictions on private loan lenders and required specific disclosures prior to issuing a loan.

- Oregon (2016) — In March of 2016, Governor Kate Brown signed a bill that requires the state treasurer and the Higher Education Coordinating Commission to conduct a study to explore approaches for lowering interest rates on student loans for students in Oregon. The report was completed in December 2016.

- Rhode Island (2016) — Signed into law July 7, 2016, S 2453 gives the Rhode Island Student Loan Authority the power to issue bonds and buy and invest in its own bonds and notes for the purposes of student debt consolidation. The agency is able to offer debt-saddled Rhode Islanders a chance to lock in lower interest rates and better terms.

- Washington (2017) — A Student Loan Bill of Rights was introduced that established a baseline for student loan servicers, in addition to creating a student loan ombudsman to help resolve student complaints and to educate borrowers about student loans. It cleared the state House and is in committee in the state Senate.

- Washington (2017) — The Washington Student Loan Transparency Act was signed into law by the Governor on April 27. This bill says that, subject to appropriations, student borrowers are entitled to receive notification about their loans from their postsecondary institution each time a new financial aid package is certified that includes student loans — this means that students will receive information on the total amount of educational loans, the range of payoff amounts including principal and interest, and additional details. This will begin on July 1, 2018. Additionally, annual compliance reports to the legislature are required in 2019-25.