More and more parents are borrowing more and more money to cover the cost of their children going to college. A November 2018 report by the Brookings Institution found:

+ the average size of parents’ Direct PLUS student loans, which allows parents of dependent children to borrow money to cover up to the full cost of college for their children (minus any financial aid received), has tripled in the last twenty-five years;

+ parents who accumulated six-figure loan debt totals on behalf of their children make up a record-high share of borrowers;

+ default rates on parent PLUS loans, while still fairly low overall, have increased by half in the last ten-year period measured.

The day before the Brookings report’s release, U.S. Secretary of Education Betsy DeVos said that rising student loan debt is creating a “crisis in higher education.” Secretary DeVos noted that 70 percent of the recent increase in student loan borrowing was attributable to a higher dollar value of loans taken out, compared to 30 percent of the increase due to expanded number of loans.

To help parents and students avoid student loan debt, many states offer programs through which families can prepay college expenses at current tuition rates, so that when it comes time for students to enroll in college the financial burden will be less and the need to take out any student loan could even disappear entirely. For families who have the desire and ability to plan ahead and invest now, prepaying college tuition could be one of the smarter financial moves to make.

Many states offer programs through which families can prepay college expenses at current tuition rates, so that when it comes time for students to enroll in college the financial burden will be less and the need to take out any student loan could even disappear entirely.

New York ranks as one of the highest states in the nation for need-based aid awarded to students, establishing itself a clear leader in making college affordable and accessible. The state’s Excelsior Scholarship program, begun in 2017 and phased in over three years, will allow resident students from families with annual incomes less than $125,000 to attend any State University of New York (SUNY) or City University of New York (CUNY) school tuition-free. A prepaid tuition program for SUNY and CUNY schools would be an avenue for students and their families not eligible for an Excelsior Scholarship also to avoid the prospect of incurring loan debt. In addition to increasing access to schools in the SUNY and CUNY systems overall, such a program could entice many students — people who surveys show are increasingly questioning the value of paying the increasing costs of a higher education[1] — to consider enrolling in a SUNY or CUNY school. Prepaid tuition programs of other states offer examples and models for programs and legislation that could be enacted in the Empire State.

Prepaid Tuition Plans

All fifty states and the District of Columbia offer some form of a 529 Plan education savings and investment program. 529 Plans, officially called “qualified tuition plans” and nicknamed for the section of the IRS Code that established them, offer tax-advantaged investments designed to encourage families to save for the future education costs of their children. Investments in 529 education savings plans grow tax-free, and funds can be withdrawn tax-free for qualifying higher education expenses, including tuition and fees, room and board (or even off-campus housing), required textbooks, student laptop computers, and more. These plans are sponsored by states, state agencies, or state educational institutions, and several states have tapped the potential of these plans to innovate with prepaid tuition programs.

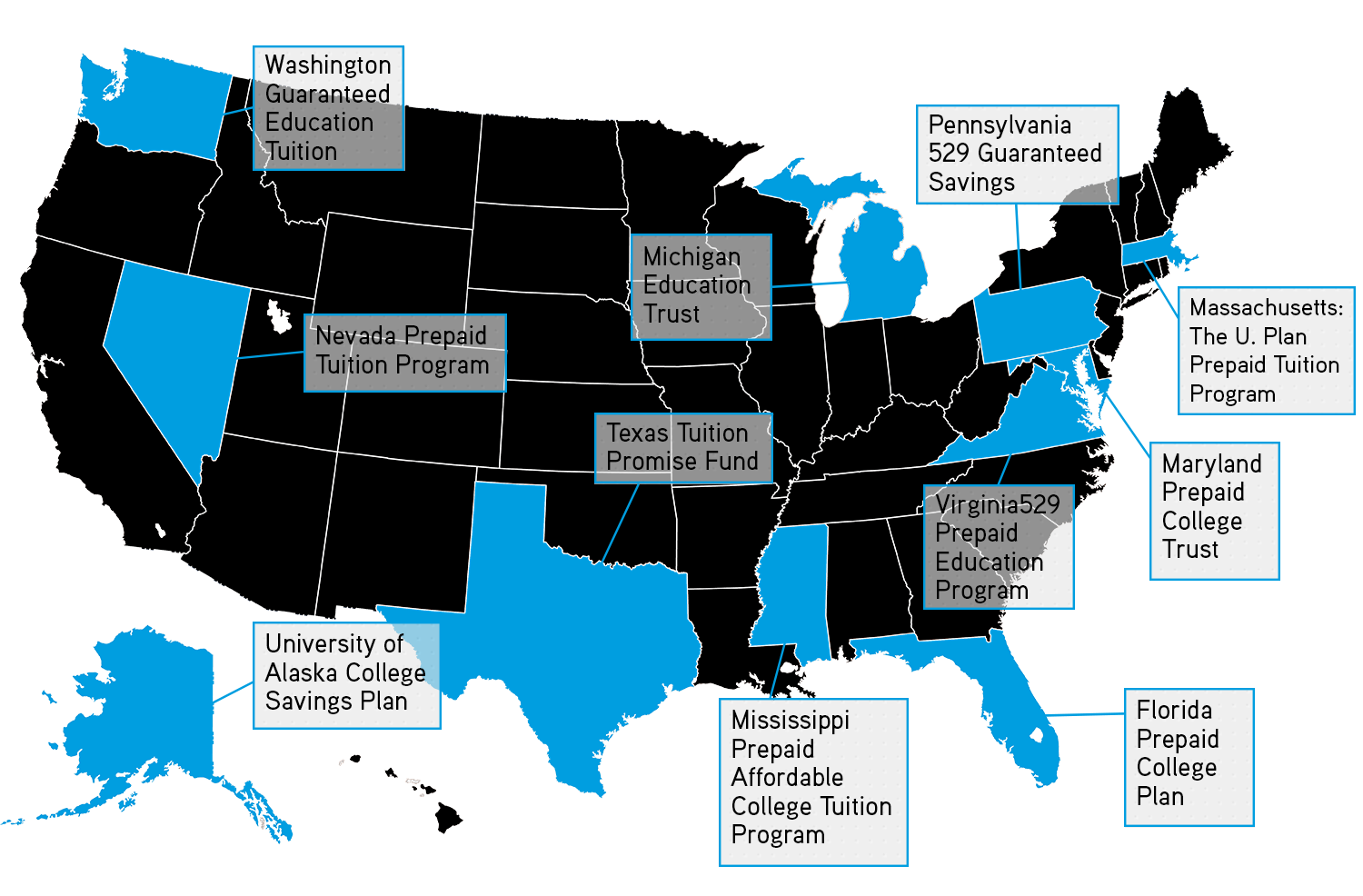

Eleven states currently use their 529 Plan structure (or something similar) to offer a prepaid college tuition plan. These initiatives, most of which offer the opportunity for parents to lock in tuition costs at state schools at their current rates, are summarized below.

States that Offer Prepaid College Tuition Plans

University of Alaska College Savings Plan: Alaska created one portfolio, ACT, among its 529 Plan options where earnings on investments are guaranteed to keep pace with tuition at the University of Alaska (UA), meaning that each contribution made to the plan essentially locks in a proportionate percentage of UA tuition at its current level.

Florida Prepaid College Plan[2]: Florida’s Prepaid College Plan is the largest in the nation, and one of the oldest, and notes that it is “helping over one million Florida families save and lock in the future cost of attending Florida’s public institutions.” Families have the ability to set up a monthly payment plan that guarantees full coverage of tuition and most fees at any of the state colleges and universities. At current rates, $186.28 per month from the time a child is born is guaranteed to cover tuition and fees for 120 credits (the typical amount for a bachelor’s degree) at any of the state’s core universities. Similarly, $55.42 per month is guaranteed to cover the tuition and fee charges for enough credit hours to earn an associate’s degree at a community college. Multiple variations of plans are available — such as two years at a community college and two years at a university — and plans to prepay for housing costs also are available.

Maryland Prepaid College Trust: Families have the option of prepurchasing anywhere from one semester to four years at a state university, one or two years at a state community college, or two years at a community college plus another two years at a state university. Payment plans can be structured as equal annual payments, monthly payments over a five-year period, a one-time lump-sum deposit, and other options.

Massachusetts: The U.Plan Prepaid Tuition Program: Run through the Massachusetts Education Finance Authority, this program allows students to purchase Tuition Certificates, with the value of the investment locking in the proportion of tuition it would buy today for any future year. Thus, if tuition at a state university is $10,000 today, buying a $5,000 Tuition Certificate is guaranteed to cover 50 percent of tuition no matter how much tuition increases in the future.

Michigan Education Trust (MET): MET-participating families can purchase tuition credits by the semester, the year, or the credit hour at current tuition rates and use them at any time over the next fifteen years.

Mississippi Prepaid Affordable College Tuition Program (MPACT): Families can purchase credit hours at current tuition rates for use by students at later dates. For 2018-19, the costs are approximately $267 per credit hour for semester-based universities and about $103 per credit hour for semester-based community/junior colleges.

Nevada Prepaid Tuition Program: Families have the option of purchasing one, two, or four years at a state university, two years at a state community college, or two years at a community college plus another two years at a state university. Payment plans can be structured as equal monthly payments over a five-year period or a one-time lump-sum deposit. Students have six years after high school graduation to use their benefits, and the tuition benefits are transferable to any qualified higher education institution in the country.

Pennsylvania 529 Guaranteed Savings Plan (GSP): The GSP program, open only to Pennsylvania residents, allows families to purchase “GSP credits” at various rates, each tied to the current tuition for different types of colleges and universities (state community colleges, state and state-related colleges and universities, private colleges, etc.) to be used in the future. For most four-year colleges, ninety-six GSP credits cover four years of tuition and sixty GSP credits cover the tuition cost for an associate’s degree. (GSP accounts also can be used to pay for tuition up to $10,000 at elementary and secondary public, private, or religious schools.)

Texas Tuition Promise Fund: This fund lets families and individuals prepay for all or some future tuition and fees at any two- or four-year Texas public college and university. People purchase “tuition units,” which represent a fixed amount of undergraduate resident tuition. The number of units needed varies depending on the school, but generally 100 units represents thirty semester hours, which is considered to be one academic year. Purchases can be made in lump-sum blocks of twenty-five or more tuition units, or monthly or annual payment plans over five or ten years.

Virginia529 Prepaid Education Program (VPEP): Virginia’s prepaid tuition program allows families to buy Prepaid529 Semesters, which are offered at current tuition rates and cover any future semester’s costs of tuition and mandatory fees at a Virginia four-year college or university (or about 2.6 future semesters at a Virginia public two-year college). Investors can pay in full, set up a monthly payment schedule, or make a partial down payment and spread out payments for the balance.

Washington Guaranteed Education Tuition (GET): This plan sets the cost of one year of resident undergraduate tuition and mandated fees at the state’s most expensive public university at 100 units, and then allows parents to buy as many units as they want. The current price is $113 per unit. Each unit retains the value of 1/100th of the price of tuition at Washington’s most expensive public university at any time, and the benefits are portable, with their monetary value able to applied to almost any other in-state or out-of-state college or university. If the student receives a scholarship that covers tuition, the GET benefits can be used to cover the costs for room and board or other expenses. Benefits can be used up to ten years after the selected benefit use year (usually the school year after high school graduation) and typically are transferrable to other family members. Since the program’s inception in 1998, more than 53,000 students have used the benefits under this prepaid tuition program.

Four of these state-run tuition prepayment programs — those of Florida, Massachusetts, Mississippi, and Washington — are statutorily backed by the full faith and credit of the state, and thus the state is legally obligated to make good on the prepaid tuition arrangement. The Texas Tuition Promise Fund, that state’s newest prepaid tuition plan, is guaranteed by the state’s public colleges. The programs in two other states — Maryland and Virginia — are backed with only a “legislative guarantee.” While this serves as a public statement of support and commitment to the program, it is not a guarantee that any funding shortfalls realized in the programs will be covered by the state, and does not bind the legislature to action or continued funding of the program. Illinois, for example, closed its program in 2017-18 as political leaders considered how to address unfunded liabilities.

An additional twelve states previously offered prepaid tuition programs, but have since closed these initiatives for various reasons.[3]

Prepaid Tuition Plans for Private Colleges

Nearly 300 private colleges and universities offer prepaid tuition plans where students can lock in tuition at current rates and protect themselves from any future tuition hikes the colleges may institute. The Private College 529 Plan (the only 529 Plan not run by a state government) offers families the ability to avoid all future tuition increases for their child by paying that tuition now and buying “Tuition Certificates.” All contributions made to the program on behalf of a student between July 1st and June 30th lock in the tuition rate at all participating schools of that year, with amounts contributed by families calculated as a percentage of each participating school’s tuition.

Given the typically much-higher tuition at private higher education institutions than at public colleges and universities, substantial costs — and thus potentially substantial student debt — can be avoided by participating in this program.

For example, say tuition at the fictional private Herbert University is $35,000. The Smith family has a ten-year-old son, and they buy a Tuition Certificate from the Private College 529 Plan for $17,500. The plan locks in the value of that Tuition Certificate at 50 percent of Herbert U’s tuition. Over the next nine years, tuition at Herbert U goes up by an average of 5 percent per year and is now nearly $54,300. The Smiths’ nineteen-year-old child now applies to Herbert U and is admitted, and the Smiths redeem their certificate, which is valued at 50 percent of tuition, or $27,150, and they pay the balance. The Smiths just avoided incurring student debt of nearly $10,000 for this first year of college alone.

Schools participating in the Private College 529 Plan are contractually obligated to honor the Tuition Certificates, and Certificates are redeemable at any of the participating schools or school that choose to participate in the program in the future. And while participating in the program and purchasing Tuition Certificates does not guarantee admission to any school (it does not affect the admission process at all, in fact), students who choose to attend a nonparticipating school can have the Certificate funds rolled into a standard 529 Plan college savings account (see above) and are free to withdraw funds to cover costs at any eligible college or university they choose.

A Prepaid Tuition Plan for New York?

Parents and students looking to avoid crushing levels of student debt are turning more and more toward prepaid tuition plans. In New York, a state-sponsored prepaid tuition plan for its public colleges and universities could expand access to SUNY and CUNY for tens of thousands of students while creating a new pathway around student debt.

Nearly a dozen states are offering innovative variations on prepaid tuition plans, and those with a track record of substantial activity offer a sense of program design and features that are particularly appealing to parents and students. The importance of structuring these programs with some form of guarantee, whether state- or institution-backed, also is evident when examining the history and evolution of these plans in other states.

Policymakers in New York have an opportunity to create a prepaid tuition plan for CUNY and SUNY that builds upon the best elements of the plans in other states. One of the best strategies of dealing with student loan debt is to avoid it in the first place.

NOTES

[1] See, for example, Josh Mitchell and Douglas Belkin, “Americans Losing Faith in College Degrees, Poll Finds,” Wall Street Journal, September 7, 2017, https://www.wsj.com/articles/americans-losing-faith-in-college-degrees-poll-finds-1504776601; Jon Marcus, “They still value a degree, but Americans increasingly question the cost,” Hechinger Report, May 11, 2017, https://hechingerreport.org/still-value-degree-americans-increasingly-question-cost/; and Dian Schaffhauser, “Survey: 4 in 5 Parents Question Value Proposition of College,” The Journal, December 7, 2015, https://thejournal.com/articles/2015/12/07/4-in-5-parents-question-value-proposition-of-college.aspx?m=1

[2] “Explore Our Prepaid Plans,” Florida Prepaid, accessed December 19, 2018, http://www.myfloridaprepaid.com/prepaid-plans/, and “Build the plan that works for your budget and goals – get all four years at once or start with a 1-Year or 2-Year Plan,” Florida Prepaid, accessed December 19, 2018, http://www.myfloridaprepaid.com/wp-content/uploads/FPCB-PrepaidPlanComparisonChart.pdf

[3] These include programs in the following states: Alabama, Colorado, Illinois, Kentucky, New Mexico, Ohio, South Carolina, Tennessee, Texas, West Virginia, Wisconsin, and Wyoming.

ABOUT THE AUTHORS

Brian D. Backstrom is director of Education Policy Studies at the Rockefeller Institute of Government

Nicholas Simons is a project coordinator at the Rockefeller Institute of Government

READ THE SERIES

A Deeper Look at Student Loan Debt in New York State

Understanding the actual size, scope, and impact of student debt in New York is critically important if issues are to be properly addressed and solutions appropriately tailored to provide the most effective relief.

How States are Protecting Student Loan Borrowers

What can be done to prevent predatory lending and student loan repayment practices? The federal Department of Education believes that it has no jurisdiction in this matter or others like it. States, however, are starting to take action.

Avoiding Student Loans: Investing in Prepaid Tuition Plans

Many states offer programs through which families can prepay college expenses at current tuition rates, so that when it comes time for students to enroll in college the financial burden will be less and the need to take out any student loan could even disappear entirely.

Are Student Loan Refinancing Options Too Good to Be True?

Borrowers would do well to first understand one thing that student loan refinancing companies have in common: they intend to make money off of servicing student loans.