A repeal and replace of the Affordable Care Act (ACA) is a major priority of President Trump and the Republican-controlled Congress. The current debates are primarily along partisan lines, with all Democrats unified in opposition and most Republicans supporting various bills. Some congressional leaders, such as John McCain, are starting to call for bipartisan solutions. The ACA’s requirement that nonprofit hospitals report their community benefit expenditures is one example of a provision that is likely to have broader political support and has already yielded positive outcomes, but is not widely understood. Although the community benefit requirements has not been a central issue in the repeal and replace debates, it is time to identify components of the ACA that have broad appeal to ensure they are maintained in future legislation.

Over 60 percent of US hospitals are classified as nonprofits, making them eligible for tax exemption in exchange for providing “charity care and community benefits.” These exemptions yield substantial losses in government revenue, valued at $24.6 billion in 2011 (Rosenbaum et al. 2015). Prior to the ACA, there was controversy over whether nonprofit hospitals provided enough community benefits to justify their tax-exemption status, or whether their investments led to meaningful improvements in community health. The ACA implemented a new mandate that nonprofit hospitals report their spending on community benefits and programs to the Internal Revenue Service, identify specific community needs to be addressed, and allocate funding towards specific community benefits from 2009.

However, the benefits cannot be used to expand the hospital’s market share. For example, a hospital focusing on heart disease in the community cannot distribute promotional materials about heart disease that also include advertisements for its maternity ward. These provisions support the ACA’s focus on using community health activities to improve preventive care and population health (James et al., 2016) as well as the general goals of increasing financial transparency and improving accountability.

Community benefits may include charity care, Medicaid and other means-tested government programs, community health improvements, health professional’s education, subsidized health services, research, and cash or in-kind contributions to community groups (IRS 2016 Instructions for Schedule H Form 990). Three-quarters of community benefit expenditures in 2014 are in the form of financial assistance, with the remaining expenditures providing benefits such as community health improvements, education for health professionals, subsidized health services, research, and cash or in-kind contributions to healthcare organizations or community groups.

First, financial assistance benefits are free or discounted health services for consumers who cannot afford healthcare services due to lack of insurance, underinsurance, or an inability to pay their out-of-pocket costs. They include providing charity care at no cost to consumers (e.g., Saratoga Hospital provides Financial Assistance to those who have inadequate or no health insurance coverage) and covering the cost of unreimbursed expenditures for low-income consumers enrolled in Medicaid, State Children’s Health Insurance Program (SCHIP), or other government insurance programs.

Second, benefits to the community are expenditures to protect or improve the community’s health or safety. They include direct community health improvement services, such as supporting childhood immunization efforts. Community benefit operations are activities associated with community health needs assessments, community benefit program administration, and fund raising or grant writing for community benefit programs (e.g., St. Peter’s Community Health Benefit Plans). These benefits further include educating health professionals (e.g., St. Peter’s Hospital trains professionals on how to administer Narcan), offering subsidized clinical health services (e.g., Saratoga Hospital’s community health center), conducting research (e.g., studies sponsored by the hospital), and providing cash and in-kind contributions to healthcare organizations and other community groups (e.g., Saratoga Hospital sponsors the Saratoga County Community Health Council).

Are Obamacare’s Community Benefits Reporting Requirements Successful?

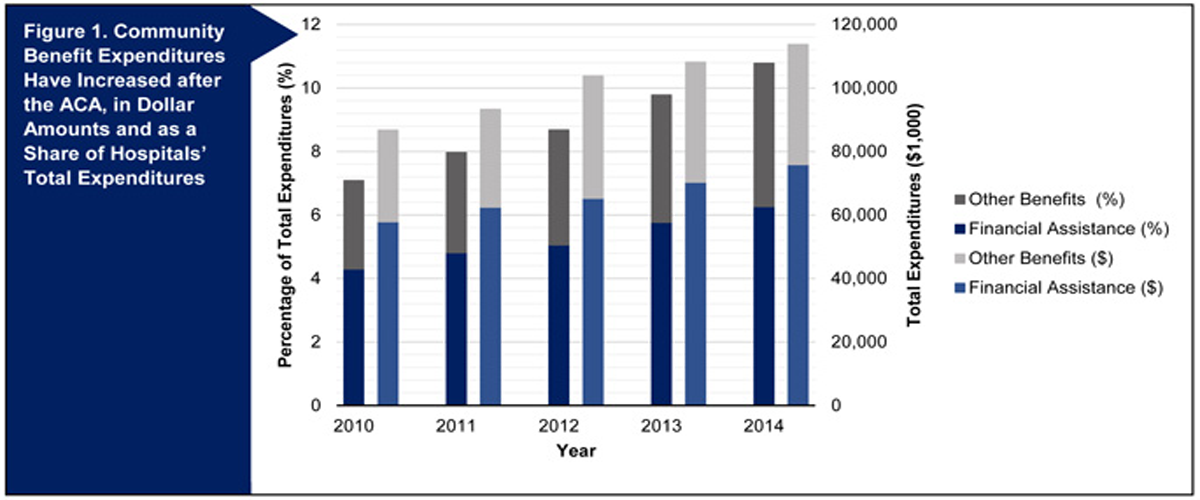

Our analysis of IRS 990 Form Schedule H data shows that this transparency has increased reported community benefits over time, both in dollars and in the share of hospitals’ total expenditures. From 2010 to 2014, the total amount of expenditures has increased $27.6 million, from $83.4 million to $111 million. As a share of nonprofit hospitals’ total expenditures, the amount spent on community benefits has increased 3.6 percent, from 7.1 percent to 10.8 percent. The relative allocation between these two has remained steady over the years.

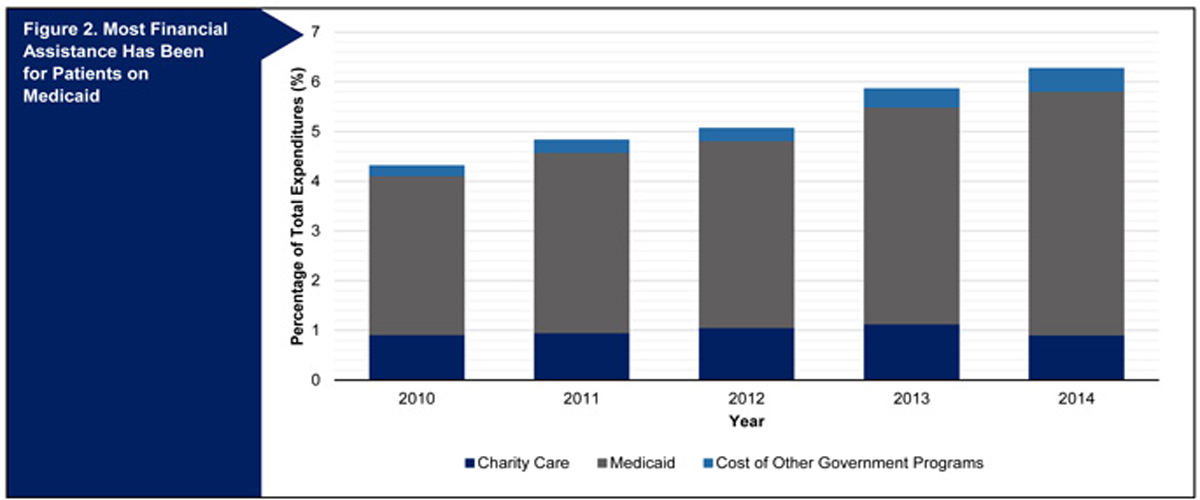

The majority of financial assistance has covered out-of-pocket expenses for patients on Medicaid. This is the largest share of financial assistance overall ($66.7 million in 2014, representing 4.9 percent of total expenditures). Charity care is the second-largest expenditure type in the financial assistance category ($5.8 million in 2014, representing 0.9 percent of total expenditures). The remaining portion of direct financial assistance is to consumers on other forms of public insurance such as SCHIP.

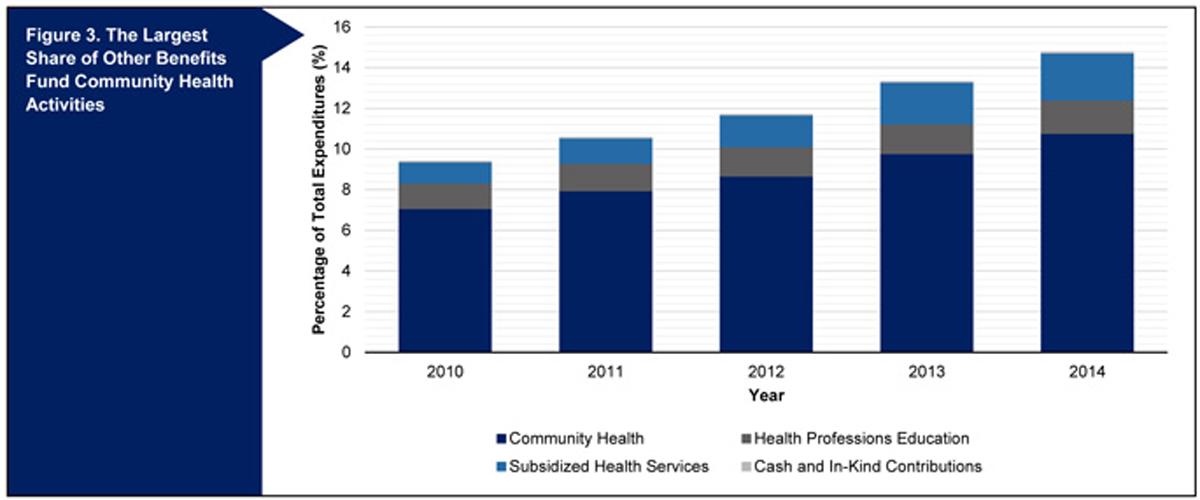

“Other benefits” that do not provide direct financial assistance to consumers have also increased. From 2010 to 2014, the total amount of expenditures for other benefits has increased by $8.9 million, from $28.5 million to $37.4 million. As a share of nonprofit hospitals’ total expenditures, the amount spent on other benefits has increased 1.7 percent, from 2.8 percent to 4.5 percent. Among the other benefits, the largest portion is for community health benefits ($2.5 million in 2014, representing 0.04 percent of total expenditures). However, education for health professionals, subsidized health services, and cash and in-kind contributions for community benefits, which comprise the smallest portion of total expenses, have not significantly increased.

What Is the Future of Nonprofit Hospital Community Benefit Expenditure Reporting?

Prior to the ACA, there was considerable debate over whether it was appropriate for nonprofit hospitals to receive tax exemptions based on their provision of community benefits. The ACA’s requirements that nonprofit hospitals report their community benefits has succeeded in improving their financial transparency, and data show that their reported community expenditures have increased since 2010. While community benefit expenditures are largely for Medicaid and charity care, community health improvement expenditures are critical to improving population health by addressing community health needs, which is one of the principal goals of the ACA. More investments in community health improvement and health profession education are required.

As repeal and replace conversations continue, it is important to recognize that the ACA contains many provisions beyond the most visible components of Medicaid expansions and tax penalties for those without insurance. While tax-exempt hospitals aligned hospitals’ expenditures with community health needs, these debates ignore smaller aspects of the legislation such as non-hospital reporting requirements and demonstration projects that have the potential to have bipartisan support and improve cost, access, and quality outcomes.